Mad in Pursuit Notebook

Neighborhood Banking, 1925-1930

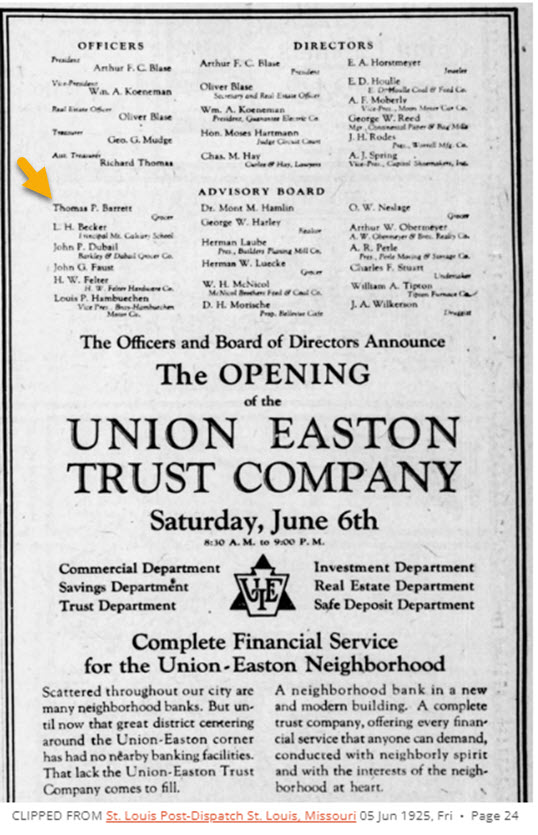

Found: an ad for the opening of Union-Easton Trust, 6 Jun 1925 (image above). Among the Advisory Board members was my grandfather Thomas P. Barrett.

Background. In June of 1925, my grandparents owned and operated two grocery stores in this neighborhood and had just had their fourth child. They owned a few properties and Tom was ambitious to own more. It was the Roaring Twenties, boom years between the end of World War I and the Great Depression. What did it mean to be on the Advisory Board?

Research. According to the article below, the Advisory Board would consist of "shareholders." I assume this meant business owners who had money in savings accounts, rather than actual investors in the enterprise.

The bank took a year to build. A full-page ad in the Sunday Post-Dispatch before it opened (31 May 1925) celebrated all the local construction businesses that helped build it. Another group of businessmen had proposed a second bank nearby, but 75 local merchants got together and decided they would only support one bank in the neighborhood (10 Apr. 1924).

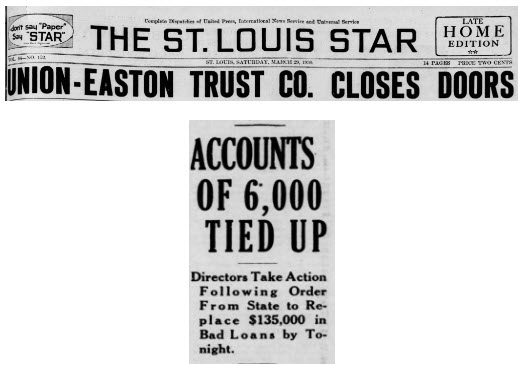

Reversal of fortune. In 1926, Tom Barrett died. This left my grandmother Kitty holding the bag in 1930 when the U.S. banking system collapsed. Was Kitty one of the lucky ones? Were the Union-Easton officers and board among the prudent bankers who protected their depositors?

No.

The bank officers said that rumors had caused a run on the bank—depositors racing to withdraw their money all at once (see "It's A Wonderful Life").

Shenanigans. The Missouri Commissioner of Finance ultimately told a different story. In a nutshell, the lawyer president of the bank, Arthur F. C. Blase, had a second bank, Provident Loan & Investment Institution, which specialized in second and third mortgages and somehow wriggled out from under state control. Blase had used the Union-Easton funds to prop up Provident. Adding insult to injury, Blase took out a loan for himself amounting to $21,000 shortly after Black Tuesday, which of course he never repaid.

The whole house of cards collapsed.

By 1937, only 36 cents on the dollar had been repaid to creditors and depositors, with state authorities estimating that no more than 56% would ever be repaid. The FDIC (Federal Deposit Insurance Corporation) was not signed into law until 1933—too late for the 6000 wage-earners and small-business owners sunk by Union-Easton.

My grandmother Kitty was not as romanced by the real estate business as my grandfather was. By the time the Great Depression crashed the economy, she had tidied up her affairs--operating a single grocery store and managing a couple of nearby rental properties herself. Although she ran a brisk cash business and probably needed occasional short-term loans to stay afloat, I doubt she kept much in savings. I always like to think she was nobody's fool.

The bank building is now a community center.

(Revised 8 Jan 2024)

FOLLOW me on my Facebook page, share this post to your friends, and....

Books from Mad in Pursuit and Susan Barrett Price: KITTY'S PEOPLE: the Irish Family Saga about the Rise of a Generous Woman (2022)| HEADLONG: Over the Edge in Pakistan and China (2018) | THE SUDDEN SILENCE: A Tale of Suspense and Found Treasure (2015) | TRIBE OF THE BREAKAWAY BEADS: Book of Exits and Fresh Starts (2011) | PASSION AND PERIL ON THE SILK ROAD: A Thriller in Pakistan and China (2008). Available at Amazon.